India has witnessed robust economic growth over the last 2 decades which has led to rapid urbanisation across the country. It has been observed that the rate of increase in vehicle ownership across the country is higher than the population growth rate. The number of vehicles per 1000 population was 51 in 2001 and it has more than tripled to 222 in 2019.

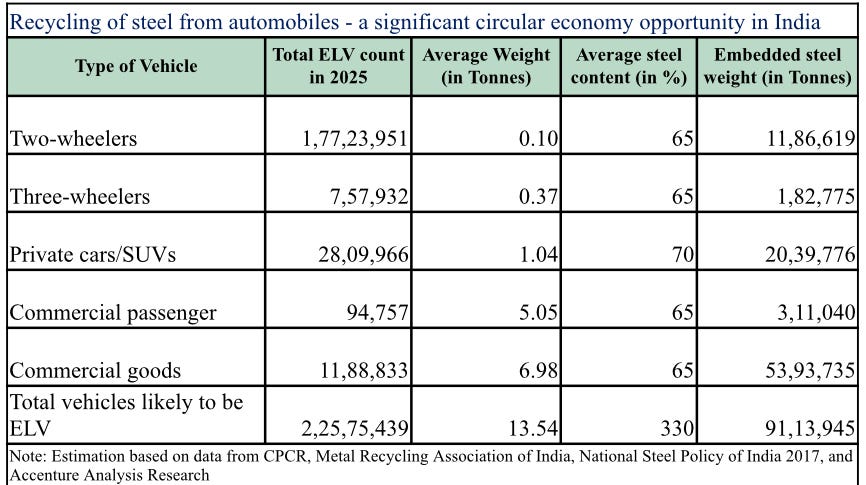

By 2025, India will have a monumental load of over 2 crore old vehicles nearing the end of their lives. These, along with other unfit vehicles, will cause huge pollution and environmental damage says a report by the Centre for Science and Environment (CSE).

“With growing motorisation and obsolescence of vehicles, cities and regions are getting burdened with junk and grossly polluting vehicles. A well-designed policy at this stage can help to renew the fleet to leverage the new investment in BS VI emissions standards and accelerate fleet electrification for clean air.”

Voluntary scrapping of old cars is proposed by Union Budget 2021–22:

It is focused on health tests for personal vehicles over 20 years and for commercial vehicles over 15 years. A comprehensive scrappage policy will result in a reduction in costs, save foreign exchange and increase revenues in the long term.

If the policy is defined well, 9+ million vehicles could go off roads by fiscal 2021 and 22+ million by 2025. It would reduce carbon dioxide emission by 17% and cut particulate matter in the air by 24%.

This would lead to scrap metal recycling, better protection, reduced air pollution, lower oil imports due to higher fuel consumption of existing vehicles, and encourage investment.

The policy can be a win-win for all, as the consumer would benefit from the scrap value, GST savings and discounts, while a dealer would gain from demand for new vehicles. For a vehicle maker, recycled metals would be available at a cheaper rate, and the government could save forex because of lower imports of these raw materials as well as get tax revenue from new vehicle sales

Scope for Organised Private Players in India

Participation from the private sector should be encouraged. A mix of private and public sectors working in the competition will be more efficient. In the end, amid all promises and challenges, the vehicle recycling industry in India represents a huge potential for scrap generation. India, being a developing country, needs to tap into such green, sustainable industries for long-term benefits.

According to a SIAM report to the government, total number of vehicles registered from 1st April 1990 to 31st March 2000 is 30.55 million, and has the potential to generate INR 320 billions worth of scrap value.

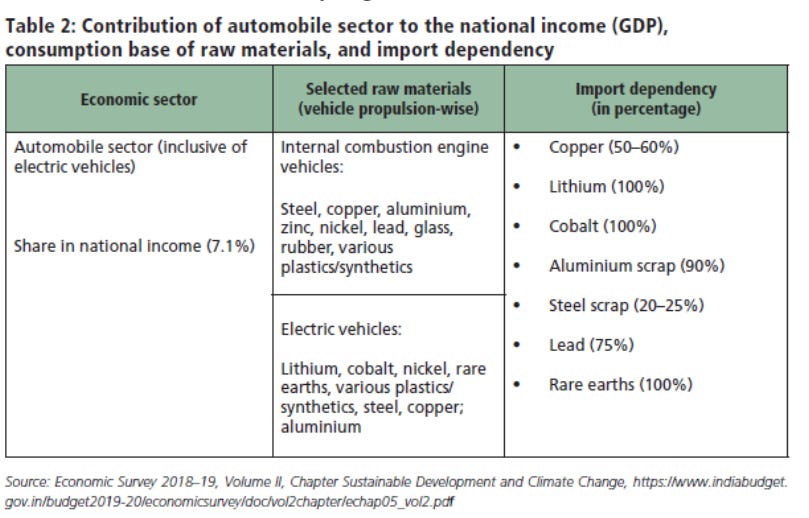

A car weights 800-1,200 kg on average. It contains 65-70% steel scrap, 7-8% aluminium scrap, 1-1.5% copper scrap and 15-20% rubber and plastic scrap upon recycle. A recycled car will earn approximately INR 22000-30000 at existing scrap rates.

Assuming 20-25% of vehicles are scrapped in first year, it has a potential of generating around 6 million tonnes (mnt) of scrap; ~150,000 mt copper scrap; ~0.8 mnt aluminum scrap and ~1.8 mnt plastic/rubber scrap & projected to produce roughly USD 2.9 billion. Such statistics are expected to rise with time.

Assuming 20–25% of vehicles are scrapped in first year, it has a potential of generating around 6 million tonnes (mnt) of scrap; ~150,000 mt copper scrap; ~0.8 mnt aluminum scrap and ~1.8 mnt plastic/rubber scrap & projected to produce roughly USD 2.9 billion. Such statistics are expected to rise with time.

Opportunity

We are moving toward an electric age. It is likely that in the next three to four years, people will be trading in their petrol or diesel vehicles for EVs or hybrid which is driven by low travel costs and helps to improve the environment.

- Demand & Job creation:- The vehicle scrappage policy is expected to create huge job opportunities along with the demand for new vehicles in the Indian auto industry which has been suffering for a few years.

- Pollution Control:- With the older vehicles about to go off the roads replaced by the new and lesser polluting vehicles, expect the vehicular pollution contribution to be reduced substantially, once the vehicle scrappage policy is implemented. The old vehicles are estimated to cause 10-12 times more pollution than the new vehicles.

- OEMs to witness business boost:- Phasing out of these old and polluting vehicles is expected to increase the demand and sales in the domestic auto industry. This would also result in the overall turnover growth of the auto industry by around ₹5.5 lakh crore from the current ₹4.5 lakh crore.

- Benefits for vehicle buyers:- As of now, there is only one direct benefit announced for the vehicle buyers under the vehicle scrappage policy. The customers will receive a 5% rebate on the new car purchase after sending their old cars to the junkyard.

- Reduced import cost:- India’s appetite for steel is growing, at 60.6 kg per capita compared to over 400 kg per capita in the developed nations. Ferrous scrap being one of the key raw materials for the secondary steel manufacturing units. India’s scrap requirement for steelmaking is about 16-18 mnt pa. Of this requirement, about 1/3rd of the material is imported.

India’s appetite for steel is growing, at 60.6 kg per capita compared to over 400 kg per capita in the developed nations. Ferrous scrap being one of the key raw materials for the secondary steel manufacturing units. India’s scrap requirement for steelmaking is about 16–18 mnt pa. Of this requirement, about 1/3rd of the material is imported.

India’s appetite for steel is growing, at 60.6 kg per capita compared to over 400 kg per capita in the developed nations. Ferrous scrap being one of the key raw materials for the secondary steel manufacturing units. India’s scrap requirement for steelmaking is about 16–18 mnt pa. Of this requirement, about 1/3rd of the material is imported.

By using that recycled Raw materials in manufacturing automobiles would see a significant drop in their prices. This will eventually benefit the common buyers as they will spend a shell out a lesser amount for buying new vehicles.

In addition to a new business line, recycling of the ELVs offers a big opportunity for producing recycled metal like steel, aluminium, and copper, etc. which will, in turn, reduce the cost of raw material as they shall be procured in-house instead of importing them.

Challenges & Possible Solutions

- First challenge is the task of an organised recycler to source ELVs. With the dominance of the unorganised sector, for an organised recycler, to get a regular inflow of vehicles is a huge task. It needs to be managed very proactively.

- Though being A high volume – low margin business makes it challenging from the cost point of view. As a recycler, it’s essential to be close to the city hub where there is a large consumer base, but have to consider the real estate cost near cities.

- To have skilled staff is a challenge; vehicle recycling is not only labor-intensive, but the process of recycling a vehicle is extremely complicated; there are many parts to be recycled and many hazardous materials to be removed.

- The logistics cost of moving steel from various collection centers to the shredding unit can become prohibitive. India needs large number of medium/small shredders serving local areas, where finished products are made to control the logistics cost.

- Shredders are expensive machines and require a lot of electric power. To be viable in India, a shredder must run 2-3 shifts a day, 7 days a week & need a lot of steel to be viable to operate. The government should give higher priority to setting up dismantling units. It should be economical to transport the ELVs to the unit. If it is an 8-tonne unit, working 15 hours a day will need 250 cars/day; 6,000 cars/month; 72,000 cars per annum.

- Shredders are expensive machines and require a lot of electric power. To be viable in India, a shredder must run 2–3 shifts a day, 7 days a week & need a lot of steel to be viable to operate. The government should give higher priority to setting up dismantling units. It should be economical to transport the ELVs to the unit. If it is an 8-tonne unit, working 15 hours a day will need 250 cars/day; 6,000 cars/month; 72,000 cars per annum.

The government needs to promote the scrappage policy in 3 different Phases:

Phase 1. Offer sizeable financial incentives along with other Tax benefits to attract the majority of the consumers.

Phase 2. Develop a resale market for the scrappage certificate for those who don’t want to replace their scrapped vehicles with new.

Phase 3. Cut the life period for commercial vehicles to 10-12 years from the currently proposed 15 by promoting various environmental benefits to the Country as a whole.

There are various schemes & Strategies can be designed in Phase 3 and this all depend upon the Success of Phases 1 & 2, within given timelines..

The private investors in this industry should be given tax incentives such as duty-free import of shredders, provide land near Metros at reasonable low cost to attract Private Players, easy term loans and tax holidays for first few years.

The State governments should provide tax rebate like lower GST against scrappage certificates and manufacturers can give discounts along with benefits given by Central Govt schemes.

Bottom Line

All in all, the Indian market for vehicle scrappage and recycling is estimated at $6 billion per annum and can generate 50,000 new employment options. The scrapping strategy would improve car purchases in the country as a fresh one will certainly be purchased by the one scrapping the vehicle.

The implementation of this vehicle scrappage policy would start from 1st April 2022 and hopefully, it would bring a positive change on the environment with people realizing the impact of efficient vehicles, along with it giving a much-needed boost to the Indian automobile sector in the coming years.

At last, A big part of the responsibility also lies on the citizens of the country who need to make conscious efforts towards preserving the environment by surrendering their old vehicles.

“We are heading in the right direction for a greener environment for future generations”.